TABBY CARD

Nothing to pay today. Many ways to pay later.

Get your free Tabby Card

A reimagined daily spending card that’s made to flex

Use the card anywhere with up to AED 10,000 to spend

Skip the down payment with up to 40 days to pay

Split any purchase in 4 payments

Meet the Tabby Card

Better than a debit card. Better than a credit card. Tabby Card unlocks an interest-free spending limit of up to AED 10,000 with flexible payment options — helping you shop smarter online and in-store.

Shop anywhere you like

Use your card online or in-store with no down payments, wherever VISA is accepted.

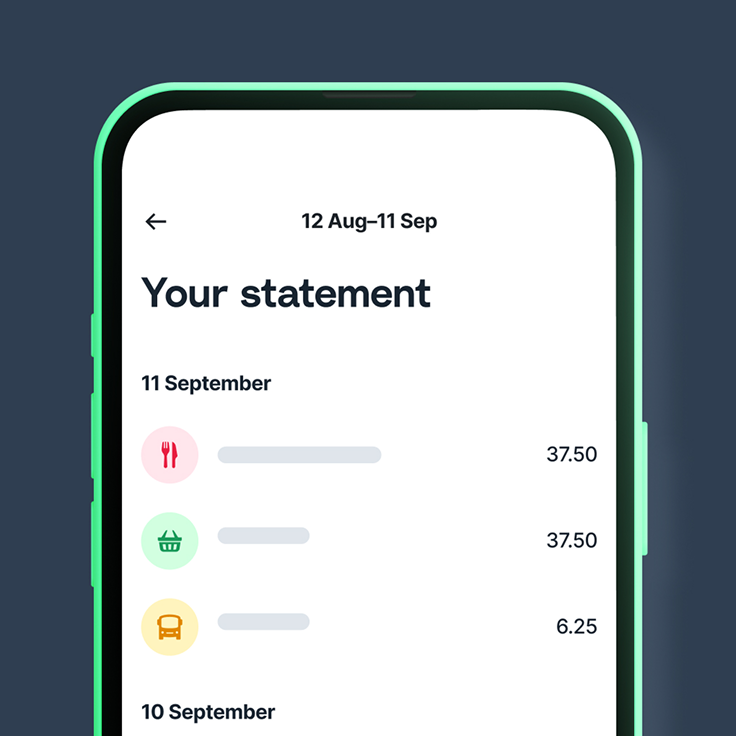

Get a monthly statement

Pay up to 40 days later, with all purchases combined into a single monthly statement.

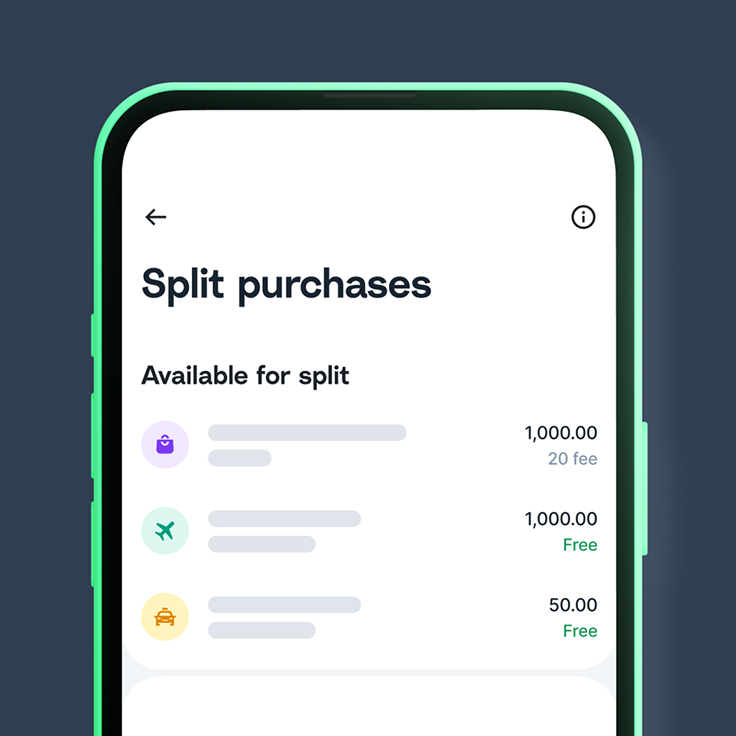

Split after purchase

Manage your spending in the app and choose which purchases to split into 4—free within Tabby Card partners. Longer plans coming soon.

No card fees. No annual fees. Total transparency.

Tabby Card comes with no hidden fees, no issuing fees and no annual fees. We believe your card should help you achieve your financial goals, not stand in the way.

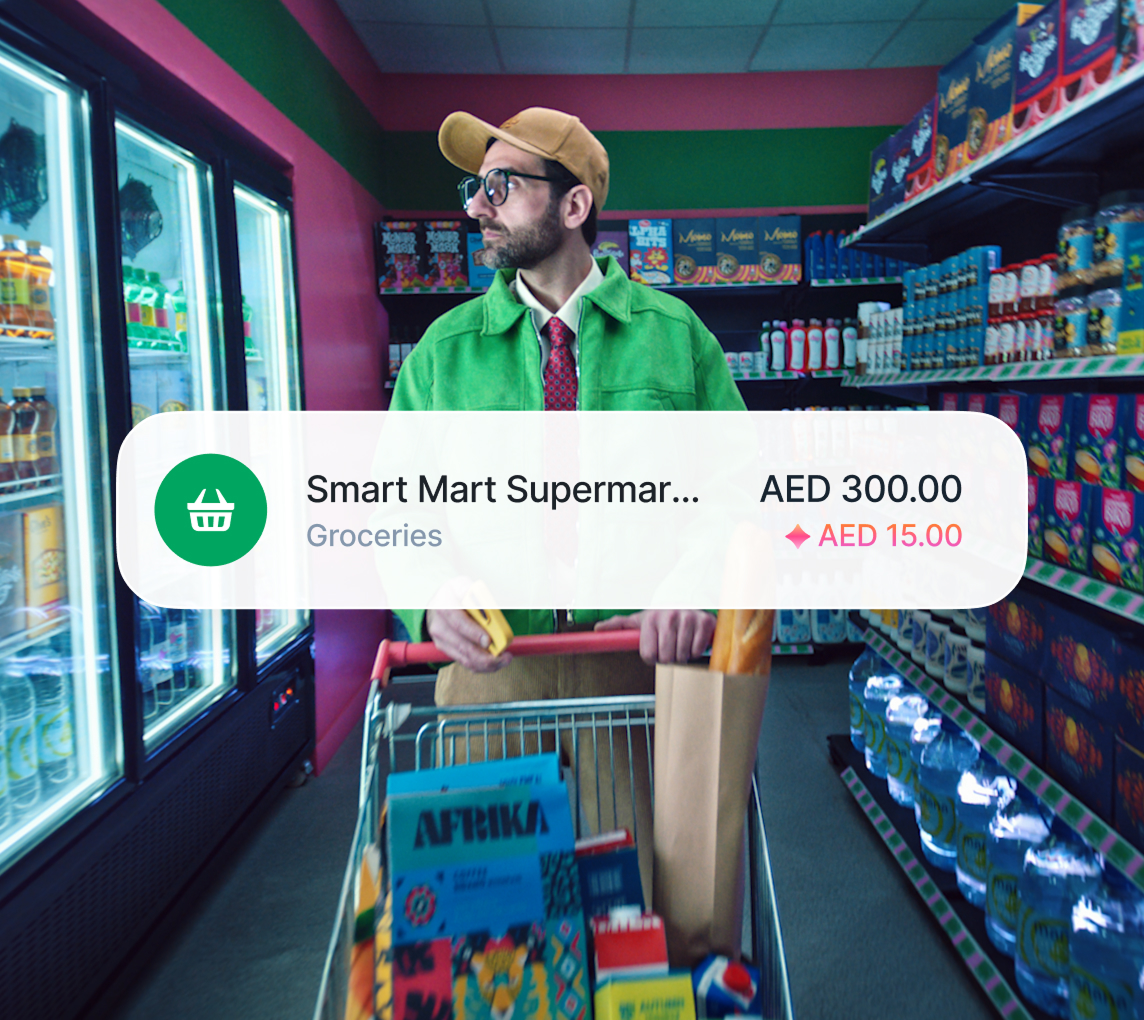

Earn 5% cashback*

From gas to groceries, choose your top 3 categories each month and earn 5% cashback on your purchases, whether online or in-store. Available on the Tabby+ plan.Which plan is right for you?

Which plan is right for you?

FreeAED 0/mo

For flexible everyday spendingPlusAED 49/mo

Get the best of Tabby, plus rewardsSpending

Virtual card

No down payment

Pay anywhere

Split in 4

Free at Tabby Card partner stores, additional charges may apply outside of the network

Anywhere

Autosplit

Rewards

Cashback

5% on selected categories

Exclusive deals

Support

In-app chat

Standard

Priority

Standard

Priority

Phone

Standard

Priority

Don’t take our word for it

With over a million members, more people in the UAE got their Tabby Card last year than any credit card. Here’s what they had to say5.0

Absolutely love my Tabby Card. Very useful for people like me, who are not eligible for credit cardAsif5.0

Tabby Card is an amazing experience! I use it everywhere, every day—for both small and big purchases—with no down payments. Absolutely LOVE IT! 😍Angelina5.0

The Tabby card is a great solution for deferred payments that can be used everywhere. I love it so much and use it daily—I highly recommend it!Islam

Now you’ve always got the winning card

Tap to pay later

Add your Tabby Card to your digital wallet to make contactless payments anywhere with Apple Pay, Samsung Pay or Google Pay.

Safe payments

Keep your Tabby Card secure with instant freeze, quick re-issuance, and account protection through password, PIN, or Face ID.

Money mastery

Keep track of your spending with a complete overview of your monthly purchases, payments and balances.FAQs

Am I eligible for the Tabby Card?

To be eligible for the Tabby Card, you must:

- Be at least 18 years of age

- Be a UAE resident

- Have a valid National ID

- Link a valid debit/credit card to cover Tabby payments

- Have a good credit history.

How do I apply for a Tabby Card?

To apply for the Tabby Card:

- Download the Tabby app

- Signup for a Tabby account

- Navigate to the Money tab

- Select Get your Card

- Complete setup and verify your identity

Where can I use the Tabby Card?

The Tabby Card is a digital Visa card that lets you shop anywhere Visa is accepted in the UAE, both online and in-store.To use your Tabby Card, add it to Apple Pay, Samsung Pay or Google Pay and use your phone at checkout like you would with any other digital debit or credit card.

How much can I spend with the Tabby Card?

Your Tabby Card balance is set at an individual level and is reassessed regularly to help you spend responsibly. You can view your available limit on the Tabby app.

Your balance adjusts like a typical credit account, it decreases when you make a purchase and increases when you make a repayment. All limits adhere to regulatory guidelines as set out by our partner bank and the Central Bank of UAE.Limits are as follows:

For annual limits, wait until the 365-day cycle renews to continue using your card. For daily limits, you can resume spending the next day.

Your balance adjusts like a typical credit account, it decreases when you make a purchase and increases when you make a repayment. All limits adhere to regulatory guidelines as set out by our partner bank and the Central Bank of UAE.Limits are as follows:

- Daily purchase limit: AED 10,000. This is the maximum amount that can be spent in a day.

- Annual purchase limit: AED 120,000. Once reached, transactions are declined until the limit resets.

For annual limits, wait until the 365-day cycle renews to continue using your card. For daily limits, you can resume spending the next day.

How does Cashback work on the Plus plan?

When you choose the Plus plan, you’ll earn 5% cashback on your Tabby Card purchases, online or in-store, across your top 3 selected shopping categories each month. You can earn up to AED 200 every month, which will be added to your Cashback balance after you pay your statement. You can use this cashback to make Tabby payments or to reduce your Tabby Card balance. You can always view your cashback balance on your Money tab.

Eligible Merchant Category Codes (MCCs) for Tabby+ cashback offers are listed here.

Eligible Merchant Category Codes (MCCs) for Tabby+ cashback offers are listed here.

TABBY CARD

Get started with Tabby Card

Apply now and get the card in 3 minutes. Available to eligible customers.

Get your free Tabby Card